In this article, we will understand what is Credit Card and how it works. Additionally, we will bust some myths about it. Also, we will learn how to save a few hundred bucks every time you pay your bills.

So, let’s begin…

Note: The user has shared his personal views. And the views, thoughts, and opinions expressed in the below article belong solely to the author.

What is Credit Card?

It is a simple card, that is lent by your banks to individuals to spend a specified amount and payback based on their payment cycle.

You can utilize it on various payment providers and get tons of discounts and rewards on different portals.

If used wisely it is a buyer’s best friend. You can get the best of the deals from merchants with little to no extra charges. And you are also safeguarded from fraud as you do not have to worry about emptying the hard cash you have in your bank accounts.

Let’s see or dive deep on further benefits of owning a Credit Card —

Is Credit Card Good or Bad?

Many businesses and online stores accept Credit Cards for Payment, which means you can simply plan your purchase or order that dream dress or accessories and pay later. But should you? That’s a million-dollar question.

You could accumulate reward points and lots of cash backs on different transactions or paying your bills, but there are also certain pitfalls you need to be aware of.

First off, you could build up huge debts if you can’t pay your bills completely every month. Further, it could become difficult to stick to your budget since you can purchase now and pay later to a certain extent. Several research studies show that people start spending more than they would spend usually.

But, if you have discipline in you, there are lots of benefits to using a Credit Card. More on that later.

Let’s dive deep to under all about Credit Card –

Credit Card Eligibility

Most of the banks can issue an individual a Credit Card based on the following Criteria –

| Age | Minimum of 18 Years Old |

| Income | Minimum Monthly or Annual Income [Usually above 2 LPA – May Vary from Bank to Bank] |

| Employment | Salaried or Self-Employed |

| Interest-Free Period | Up to 45 – 55 Days [ May Vary from Bank to Bank ] |

| ATM Cash Withdrawal Charges | Around 2.0% to 4.0% of the amount withdrawn |

There might be some other Eligibility Criteria that you should check with your Bank’s branch office.

Why Use Credit Cards?

Credit Cards can help –

- Simplify your monthly expenses.

- Help with instant Cashbacks

- Better deals

- And extra savings on select cards based on your merchant.

Let’s see a few other methods credit card companies employ to come out on top of other companies.

1. Starting-off Bonuses

While starting out there’s nothing like getting some initial lucrative cash backs with your new credit cards.

2. Cash Back

Every transaction of a certain amount you make through your credit cards has cash backs of a few backs or certain percentages.

3. Rewards Points

Reward points basically are awarded to the customer on utilizing the limit available on their card.

Which in turn can be cashed in to make further purchases. In simple terms, this is a loyalty program that card companies encourage us to continue to shop or use the services.

4. Frequent-Flyer Miles

Let’s say you travel very frequently in and out of the country. There are certain cards available that provide a very good amount of discounts and cash backs when you travel and swipe or make any purchase.

You can redeem these points for air travel or other awards.

5. Grace Period

When making payments or expenses using a debit card, your money is deducted right away.

While you can use your Credit Card and ensure you keep your money invested or saved while the bills are paid through your Credit Cards.

6. Insurance

There are various types of insurance

The following insurance covers are some of the popular ones being offered with credit cards:

- Accident Insurance

- Travel Insurance

- Credit Insurance

- Purchase Protection

There are various Credit companies that can lend you different kinds of credit cards based on your requirements.

7. Universal Acceptance

Credit Cards are globally accepted, not just that you can utilize the cards. These cards provide lots of benefits, like Frequent Mile Charges, etc.

8. Building Credit

We have always been a fan of saving money. But have you ever thought having a credit card is inevitable at this point in time for most working individuals? As the times come for when you need to buy a car or home, also while handling financial transactions or also in various other requirements it might help in the future.

One easiest way to build your credit score is by taking a loan, the credit companies basically check if you are able to settle or pay back your loans in a timely manner.

Having that Student Loan you don’t like paying off. Well, it might be a blessing in disguise as it would help keep your credit scores that are being tracked and would help in future.

More on building credit can be gained here.

When Not to Use a Credit Card

There could be tons of reasons your parent or spouse would be against getting a Credit Card.

As there’s a higher possibility that it might not be good as per the following reasons –

- You might overspend

- You already have lot of debt

- You are unable to pay your credit bill on a monthly

- You don’t accept the concept of Credit

- Unable to afford the existing bills

- Not financially disciplined

- Don’t want to pay interest on your purchases

The Bottom Line

Get a Credit Card, it would do more good than bad. And has lots of benefits and rewards in these times you can never think of.

Always follow a principle, to think twice before swiping your credit card. Or wait for 24-48 hours before you go ahead and make than luxury item that you so want to buy right now.

How to Make Wise use of Credit Cards?

We are always made to understand that having debt is bad, but if this Credit would actually help, isn’t it good.

I know it would sound trivial, but you could earn a slight interest if you simply invest your credit payment amount to your Liquid funds. And directly pay off your debt every month.

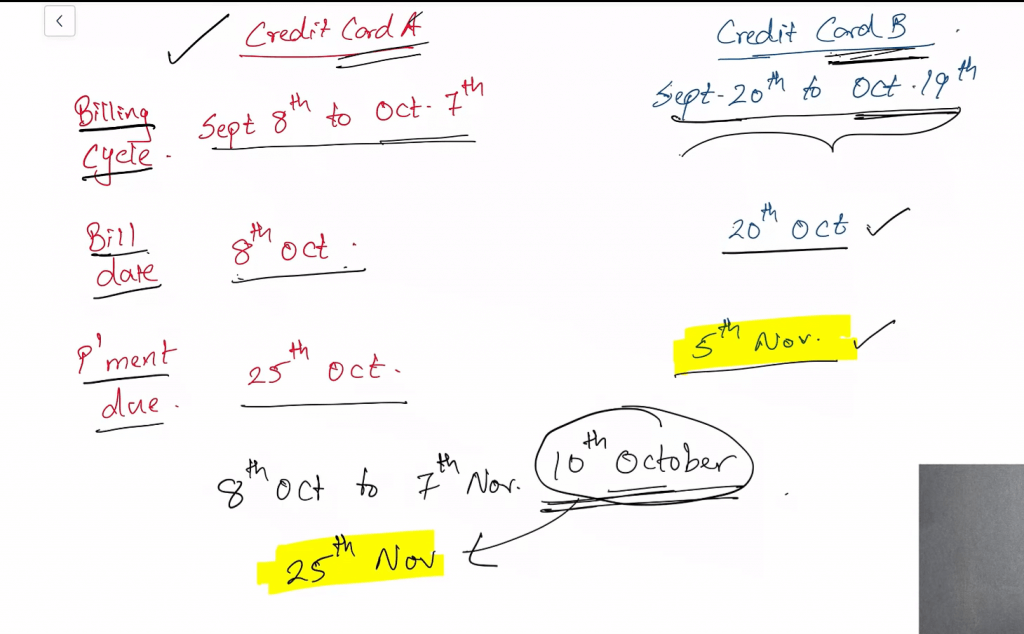

You could have multiple Credit Cards, while different banks provide different Credit cycles ranging from 45 to 52 days.

Below is a quick scribble, on how you can better utilize or manage your Credit Cards and payment cycle.

Is it a good idea to have a credit card?

Yes, if you can use a credit card responsibly, as there are limitless advantages to using a credit card. You are offered rewards, card protection, and other convenience. When further used responsibly, credit cards can be boon for your financial well-being and managing your finances. Smart credit cardholders have various opportunities to earn money just by using their card!

Will my credit score go up if I don’t use my credit card?

Not actively using a Credit Card will not have any negative impact on your Credit Score. While, after some time of inactivity your card issuer or bank might close or disable the card after inactivity. And this might have an overall impact on your score. For this very reason, it is not a good idea to have multiple cards that are won’t be used.

Is having a zero balance on credit cards bad?

Not at all. Utilizing your credit amounts is actually good overall.

Is paying bills with a credit card bad?

Frankly speaking, it is a good idea to pay your monthly bills using Credit Cards. And you should always ensure that you pay the bills in full and you shouldn’t bill them on Credit Card if you are unable to afford them.

How many is too many credit cards?

Even having more than one Credit Card is too many if you aren’t able to afford to pay bills on time.

How do I choose a credit card?

Finding and going with the best card is of most importance, further make the most use of it. Do check with the bank’s website to gain more knowledge to get the most out of your credit cards.

Conclusion/Solution

In this age of technology, why to wait or worry over checking with banks/multiple mobile applications for Unwanted or Hidden charges. You can easily track and manage your Credit cards bills right from a valuable application used by millions of users across India.

With a great interface and quick bill payment options, plus you can always get reminders on your WhatsApp to clear your bills in a timely manner. Which can definitely save you lots of unwanted interests and money.

Cred App

You can sign up for Cred using the following link and get a guaranteed Rs. 1000 and other rewards on your first payment. Additionally, you can pay your Credit Card bills during the Powerplay overs of the upcoming Indian Premier League 2022.

Use this referral link for the Cred Application.

Looking for a CRED Mint referral. Drop me a message on Instagram or Twitter. 🙂

If you are unaware of Cred Mint, it is an exclusive peer to peer investment in partnership with Liquiloans designed to get you return up to 9%

This is Suman signing off guys! Would you like to read more from me? Visit my Blog for Lifestyle Tips and also Blogging Tips.

Also, looking for some easy tips, tricks, and everyday motivation, do follow my Facebook, Instagram page. You can find me on Pinterest too.

4 thoughts on “Should You Own a Credit Card?”

I personally use Cred and totally agree with you on how it helps with managing cards and more rewards.

Wow, awesome! Glad that Cred is so widely used already.

Ekdum sahi! Credit cards really help mange my finances in difficult times. And further I love shopping with tons of discounts using Axis cards on Flipkart and Amazon.

I’m looking for Insurance on my cards, this is something I was unaware of.

Cheers!

Same here, Insurance on your cards will definitely help. If you find or aware about any Indian Banks offering them do share with us as well.